Many researchers have been concentrated in studying the persistence of underpricing

anomaly internationally. The underpricing phenomenon of Initial Public Offerings (IPOs) has

been widely studied across different stock markets around the world and it is a persistent

phenomenon all over the world.

Loughran, Ritter and Rydqvist (1994)(2) documented that the underpricing anomaly exists in all

IPO markets. They collected data for 45 countries for different periods and found that

underpricing is persistent for all the IPO markets with no exceptions but surely with different

levels.

A comparative study by Jenkinson (1990) examines the performance of IPOs in Japan as well

as IPOs in the U.S. and the U.K., and concludes that IPOs in these countries are

systematically priced at a discount relative to their subsequent trading price. In the U.S. the

discount is around 10% while in the U.K., it is around 7%. But when we see the next figures

presented by Jay Ritter and that represent the underpricing average in 2008 for many

countries, we can see that the level of underpricing has been increased in comparison to the

earlier results that were presented by many researchers.

Figure 1- Underpricing on non-European IPOs (2008)

Figure 2- Underpricing on European IPOs (2008)

Loughran et al. (1994) provide also a comprehensive survey of companies going public in 25

countries and find that underpricing is a persistent phenomenon. Ritter (2003) reports the

extent of underpricing in 38 countries and finds the same results.

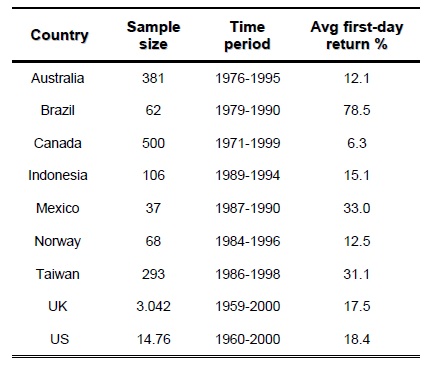

Table 1. Average first day returns of some studies (3)

2 Loughran, Ritter and Rydqvist (1994): “Initial Public Offerings: international insights”.

3 This table presents the results of some different studies that were advanced. It is a demonstration of the persistence of IPO underpricing for

different countries regardless the period of the study, to insist on the fact that this persistence is not only due to the period of IPOs.

Regardless the period, underpricing phenomenon exists for all countries.